A Conversation With Chad Willardson: How To Teach Financial Principles To Kids

Chad Willardson recently joined us on the Inside Strategic Coach podcast. As a father, entrepreneur, and financial expert, he’s passionate about showing parents how to teach financial principles to kids. This is the stuff that kids don’t get taught in school, and this mission is timely as parents step back and evaluate what’s being taught to their kids, who is teaching them, and if it’s what they want.

As entrepreneurial parents, we have the freedom to raise our kids according to the values and principles we create. And when Chad’s young child thought money just magically appeared from a “money machine box,” he realized he needed to teach financial principles to his kids, starting with the source of money and what money means.

Chad grew up in a middle-income family as the eldest of four. His parents had a 10-year-old used car and were very frugal, responsible, and charitable. However, he wasn’t taught financial principles and didn’t know much about money until he started his career.

School was canceled for his kids during the lockdown, and then brought back virtually. As they observed the virtual learning process, he and his wife reflected on whether it aligned with what they wanted.

The answer was no.

So, they decided to create a more family value-focused program that included financial principles. They checked their kids out of “the matrix” and found experts to help create a more well-rounded curriculum that included entrepreneurship, finance, communication, and public speaking, among other things valuable in the long run.

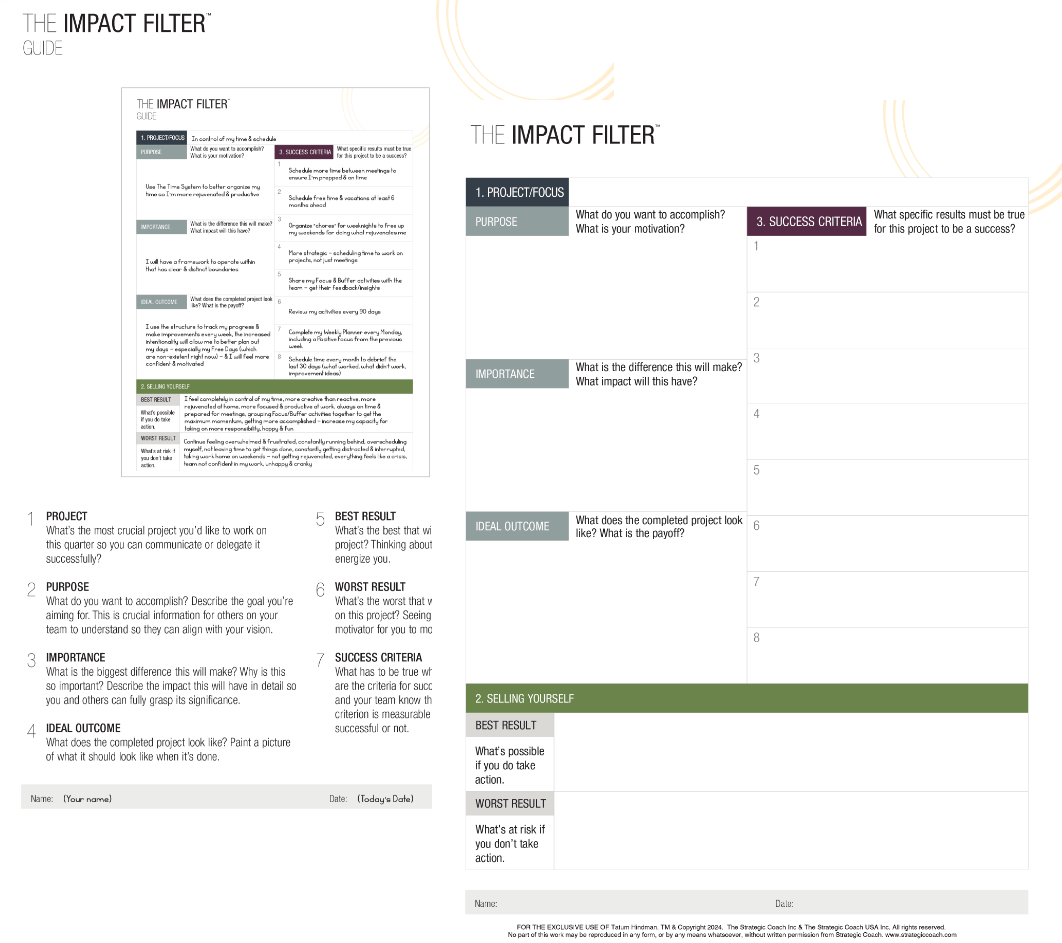

This process coincided with his writing the book, Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the Nest.

Our education system is outdated.

The education system is outdated, and I’m not the only one who thinks so. It was originally created to prepare kids for factory work, and financial principles were not on the agenda.

Kids graduate high school knowing the inner parts of a cell and how to dissect a frog, but they have no idea about investing, taxes, cash flow, or budgeting, which are things that every adult will need to know.

This fact is problematic for a growing number of parents.

Many of Chad’s clients are ambitious, growth-focused, high-earning entrepreneurs. They are also family-oriented, goals-focused, and coachable. He finds that they have an issue with what their kids are being taught and understand the need to teach financial principles.

Smart, Not Spoiled has been a hit among those who want to learn how to teach financial principles to their kids so they can enjoy financial literacy, success, and entrepreneurship in adulthood.

Have informed courage.

It takes courage to do something different from the norm.

Informed courage allows you to observe movement in a new direction—in this case, a shift in the way we educate our kids—and boldly act so your children can be prepared for what’s ahead. Interestingly, it may not be “against the norm” for long as things move in your direction.

Technology, collaboration, and the free sourcing of information are accelerating opportunities. You can teach your kids to be on the edge of that technology growth instead of tolerating and accepting a system that is so slow-moving.

You can also use tools like Kolbe, CliftonStrengths, and Unique Ability, not just in your business, but to understand how your family learns and operates.

Learn to earn.

In his book, Chad has a chapter focused on teaching financial principles by creating value and earning money doing something you like, are good at, and that someone will pay for. This is foundational for a future in the results-based economy rather than the time-based one.

Financial knowledge will give kids more confidence and clarity as they navigate their career paths. But, to depart from the norm and upgrade the way we raise and teach our kids, a few bold people must first move against the traditional system to open the doors for others.

If you want to learn how to teach financial principles to kids, first ask yourself:

- What money values and skills do your children need to learn to be successful?

- If you can’t teach them, who can?

If you’re interested in a guide on how to teach financial principles to your kids, check out Chad’s book.